Every three months I spend some hours connecting with founders at the portfolio, asking and asking to get the right information about their companies to send a clear report to the investors. It is not fun, it is not simple, I wish it would.

Since the moment entrepreneurs receive money, they have an obligation to report, these reports allow investors to know how the companies are performing and how their money is being used.

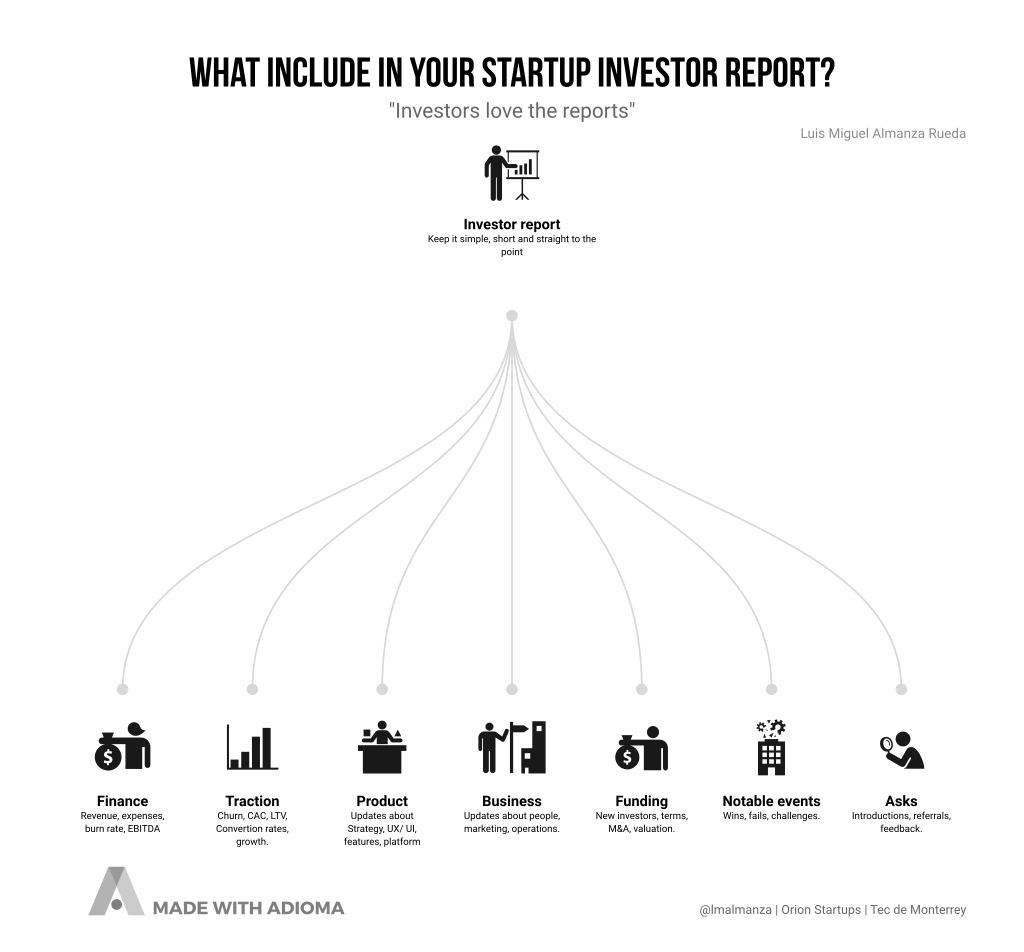

The information must be delivered constantly depending on the company maturity, team size, revenue, and new funding rounds. It needs to be easy for both sides, keep it simple, short, and straight to the point.

This happened all the time around the globe, the challenge is to make it simple, reliable and honest.

Every time I ask for the information, I feel desperate and upset because they don´t answer my emails, or don´t send relevant information.

At the same time, some investors believe that not receiving an update from a startup is probably a sign that they’re going out of business.

“Investors love the reports”

They want to know what’s going on with their investment, but they shouldn’t have to ask, the report keeps them interested about entrepreneurs progress, and help founders to clarify their advance.

According to the Angelspan.com report, where they conduct an online survey of 46 investors and advisors in the US covering 7612 startup companies: 83% of startups investors agree companies that communicate perform better and 18% of early stage startup companies provide monthly operational updates.

This process could be a pain in the ass for founders if they don´t have a formal process to do it, startup accelerators give them some tools, templates, and advice about it, for example, we at Orion Startups ask them for a simple Google form that takes 10 min to fill.

There are a lot of tools to keep the information flowing between founders and investors like:

- Reportally (https://www.reportally.com)

- Angelspan (https://angelspan.com)

- Hockestick (http://hockeystick.co)

- Xtensio (https://xtensio.com)

- Visible (https://visible.vc)

- Opstarts (http://opstarts.com/)

- Grow (https://www.grow.com)

- Baremetrics (https://www.baremetrics.com/)

With a lot of help, why is this still hurting? Time, it takes time. To be honest, nobody likes writing reports.

“Nobody likes writing reports”

All that entrepreneurs need to understand the metrics that are important for me as an investor, like an email template that can be sent every time with a specific structure and keep their eyes on key metrics & goals.

The questions are: How often? To whom should I send it? What should they include?

How often?

Once a month is a good frequency if you have enough movement at your numbers to show: revenue, traction, business operations, etc. If not, quarterly reports are acceptable and can be a good option if the startup is too early. Sending updates too often can be a problem also.

To whom should I send it?

Your obligation is to investors but is a good practice to share information with advisors.

What should they include?

1. Numbers first: Metrics and KPI´s

Month-over-month changes on your key performance indicators provide a quantitative and objective view of your startups. Include 3-5 important metrics about finance, growth, and engagement.

Finance

- Revenue: $11,200 (+27% from last month)

- Expenses: $5K ($1K marketing, $3K salaries, 500 office )

- Burn rate: $3.5K monthly, we have 18 months runway.

- Cash in the bank: $

- EBITDA: $

Traction

- Churn rate: %, an improvement of % vs last month.

- Customer acquisition: $

- Customer Lifetime Value: $

- Orders per Customer: #

- Time on site before order

- Total user accounts: #

- Active users: #

- Paying users: #

2. Product updates

For us, it is important to know and understand changes in the product strategy, including new versions, UX/UI, new features, platform, etc. If you think is necessary, include in another document screenshots.

3. Business Updates

What is relevant about people, office, partners, operations, etc.

- New hires/fires.

- Marketing strategy.

- New partnerships.

- International expansion plans.

- Operations changes.

- Press updates.

4. Funding or Mergers and acquisitions

Startups move so fast, let us know if anyone has reached out to you, what is the strategy, terms of new rounds, lead investors, etc.

5. Notable events

Notable events are milestones from your company and can be divided into wins, fails, and challenges. Big and smalls ones, anything you believe is of great importance to the success of the company.

6. Questions

For me, this is an easy way to figure out how we or the investors can help the company. Tell investors what do you want, introductions, referrals, hiring, product feedback or anything else.

Since we are investing in early stage companies, the reporting process is simple in the first months of the startup, at Orion Startups we ask for information about the company with a Google form every quarter. For companies with more time, revenue growth monthly and new investment rounds we ask for a complete report. At the end of the year, we ask for the annual financial statements in detail.

I don´t need beautiful power points, plain text is ok.