It is difficult to understand startups valuation, since almost everything is intangible there are no clear paths to define clear value for a startup.

There are many ways to project the value of a company for purposes of pricing an investment, but all of them rely on entrepreneurs projections or comparable companies as a starting point.

You can find different valuation methods, but the question is: which model does consider all the relevant factors? or which is better for my company? There is no unique answer. There is no precise valuation for early stage companies. In most cases professionals calculate a number of valuation models and scenarios and take a weighted average of them.

At the end, that number is a starting point or an instrument for a negotiation. A deal will happen for a certain price which is best known as market valuation.

Think on value and risk.

Every single thing that can add value, like a patent, a great team, traction or product development is important for the value.

At the same time, those factors decrease the risk, for example a strong team decreases the execution risk against a new and experimental team. Or good traction numbers decrease the risk of customer acquisition.

When you are ready, or you think you are ready, to ask money from investors you need to be clear about the value of your startup.

Last week we just launch Startups Valuation Lab at Orion Technology Park at Tec de Monterrey. The name of the project is OFFICE and it is launched in collaboration with Numbelt company, Finance students from Business School and Orion Startups.

The goal is to provide startups with a formal valuation, finance structure and risk analysis.

You need a valuation if you want…

- To look for investment.

- Know the company value.

- Have better finance control.

- Avoid Legal conflicts.

- Avoid structure mistakes.

- Compare with competitors.

- Curiosity.. the opportunities come from curiosity – Victor Lau.

According with Venionaire Capital, you can find three standard approaches for Enterprise Values (EV):

1. Fair Market value – the value of an enterprise determined by a willing buyer and a willing seller – both conscious of all relevant facts – to close a transaction.

2. Strategic value – the value the company has for a particular (strategic) investor. The positive effects like synergy, opportunistic costs and marketing-effects are considered and calculated for this valuation approach.

3. Intrinsic value – the measure of business value that reflects the entrepreneur’s in-depth understanding of the company’s economic potential.

At OFFICE – Valuation Lab we will be using four valuation models:

- Berkus: Valuation based on the assessment of key success factors.

- Discounted Cash Flow: Valuation based on the sum of all the future cash flows generated.

- Comparable Transactions Method ( Valuation multiples ): Valuation based on a rule of three with a KPI from a similar company.

- Real options: Valuation based on probability of future cash flows.

There are other valuation methods:

- Risk Factor Summation: Valuation based on a base value adjusted for 12 standard risk factors.

- Scorecard: Valuation based on a weighted average value adjusted for a similar company.

- Book Value: Valuation based on the tangible assets of the company.

- Liquidation value: Valuation based on the scrap value of the tangible assets.

- First Chicago: Valuation based on the weighted average of 3 valuation scenarios.

- Venture Capital: Valuation based on the ROI expected by the investor.

Berkus Method.

This is a pre-revenue method created by Dave Berkus. First you need the value of a similar company, then based on it, you define five key criteria for similar companies and the expected value to make estimation.

For example, imagine a startup that has potential of reaching over $20 million in revenues within five years, and the key criteria are: Sound Idea, prototype, Quality Management Team, Strategic relationship, Product Rollout or Sales:

These numbers are maximums limits that can be earned by the startup, all of them can form a pre-money valuation.

These numbers are maximums limits that can be earned by the startup, all of them can form a pre-money valuation.

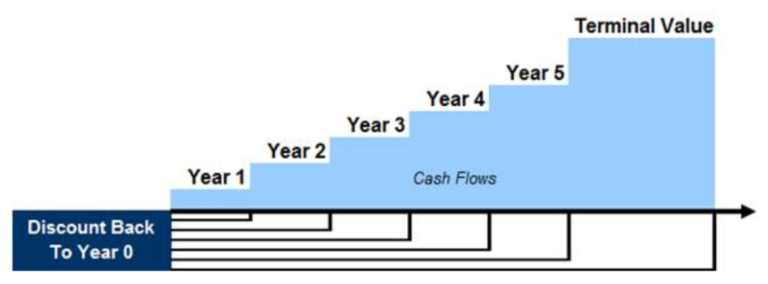

Discounted Cash Flow Method

This method is useful if your startup is doing some revenue by some years. And you can estimate the present value of your company like the sum of all the future cash flows (DCF method).

PV= DCF1 + DCF2 +…+DCFn + TV

The most important part for this method, when you are using it for startups is to estimate the number of periods for future cash flows and the Terminal Value (TV), you have two options:

1) consider your business growing generating indefinite cash flows after n years. The formula for Terminal Value is: TV=CFn+1/(k-g)

2) consider an exit after n years. You need to estimate the value of the future acquisition and discount this future value to get its net present value. TV=exit value/(1+K)/n

Comparable Transactions Method (multiples)

It is a simple rule of three using comparing other company value and key metrics with yours:

- Monthly Recurring Revenue

- HR headcount

- Number of outlets

- Patent filed

- Weekly Active Users or WAU

- Sales

- Gross margin

- EBITDA

Risk Factor Summation Methods

Similar to Berkus Method, is a pre-revenue method described by Ohio TechAngels. You determine an initial value for your startup and adjust that value for risk factors:

- Management

- Stage of the business

- Legislation/Political risk

- Manufacturing risk

- Sales and marketing risk

- Funding/capital raising risk

- Competition risk

- Technology risk

- Litigation risk

- International risk

- Reputation risk

- Potential lucrative exit

Each risk is assessed, as follows: +2 very positive, +1 positive, 0 neutral, -1 negative and -2 vey negative.

The initial pre-money valuation is adjusted positively by $250,000 for every +1 and negatively by -$250,000 for every -1.

”Reflecting the premise that the higher the number of risk factors, then the higher the overall risk, this method forces investors to think about the various types of risks which a particular venture must manage in order to achieve a lucrative exit…” – Ohio TechAngels

Scorecard Valuation Method

Also named Bill Payne Method, similar to RFS and Berkus, at this pre-revenue method, you define an initial value and adjust that value based on certain set of criteria. The difference is that those criteria are weighed up based on their impact on startup success.

- Strength of the Management Team (30%)

- Size of opportunity (25%)

- Product/Technology or Service (15%)

- Competitive Environment (10%)

- Marketing/Sales Channels/Partnerships (10%)

- Need for Additional Investment (5%)

- Other factors (5%).

Scorecard Valuation Method WorkSheet: http://bit.ly/ScorecardValuationMethod

First Chicago Method

This method, named after the late First Chicago Bank, is based on probabilities with three scenarios: worst case, a normal case and best case). It is a post-revenue method since you need financial information including revenues, earnings, cashflows, exit-horizon etc.

This model combines elements of market oriented and fundamental analytical methods. It is mainly used in valuation of dynamic growth companies

Each valuation is made with the DCF Method and add a percentage reflecting the probability of each scenario to happen.

Venture Capital Method

The method is based on the investor future returns expected. First described by Professor Bill Sahlman at Harvard Business School in 1987 .

According with industry standard, the investor set a number that your company could be sold in n years. Based on those two numbers, the investor can calculate the price to pay today for the company adjusting dilution and future rounds between now and the company sale.

Return on Investment (ROI) = Terminal (or Harvest) Value ÷ Post-money Valuation

(in the case of one investment round, no subsequent investment and therefore no dilution)

Then: Post-money Valuation = Terminal Value ÷ Anticipated ROI

Anticipated ROI: based on the Wiltbank Study, investors should expect a 27% IRR in six years. Most angels understand that half of new ventures fail.

Conclusions

Best practice is to use multiple methods for establishing the pre-money valuation for seed/startup companies.

Valuations never show the true value of your company. – Stéphane Nasser

They just show two things:

- How bad the market is willing to invest in your company.

- How bad you are willing to accept it.

The optimal amount raised is the maximal amount which, in a given period, allows the last dollar raised to be more useful to the company than it is harmful to the entrepreneur. – Pierre Entremont, Otium Capital

Notes:

Post based on Stéphane Nasser original post at Medium

Useful online tool to make your valuation: https://www.equidam.com/

or contact OFFICE – Valuation Lab services. (erika.ramirez@itesm.mx)

Read more about: